Louis Glickman, investor and benefactor, notoriously said, "The very best financial investment in the world is earth." Property is one of the only financial investments that provide considerable income as it likewise grows in worth. timeshare exit solutions reviews But how precisely do you begin buying property? How do you make the leap to Investor? That's what we're going to go over in this post. We'll cover: 5 key benefits to ending up being an investor 8 different ways to purchase property, including the advantages and disadvantages of each investing technique, and how to get started in your property investment of option How you can conserve a fortune on your realty deals by investing a little money and time in getting your real estate license This is your Definitive Guide to Ending Up Being an Investor! Prior to we take a look at the various ways you can become a genuine estate financier, let's look at the leading five advantages to buying genuine estate (What do real estate brokers do).

And who doesn't desire that? Steady income offers you freedom! You don't have to stay connected to a job you hate if you have steady financial investment earnings. You're free to pursue a career or projects you're passionate about. This is specifically crucial during the economy's unavoidable slow durations. timeshares a good investment If your day task is vulnerable to a down market, it's a huge comfort to know that you'll still have income can be found in monthly from your property investments! Then there's the truth that real estate always increases in value over time. Real estate is a finite resource; there's only so much of it, so it will naturally grow in worth.

If you hold on to the financial investment enough time, you'll be able to offer the realty for far more than you paid for it. And with that profit, you can buy bigger offers, support a more expensive lifestyle, or fund a passion task! Real estate is also among the most tax-advantaged investments readily available. The United States government desires people to purchase genuine estate since it's good for the economy as a whole. So they'll give you tax breaks (like mortgage interest and maintenance reductions) to end up being a real estate financier. Debt leveraging is where realty investing gets truly amazing! You do not have to have $200,000 in money to invest in a $200,000 residential or commercial property.

And you don't have to pay a fortune to obtain that cash. With great credit, you can still get a home loan at around 5% interest. This means property investing isn't simply for the wealthy. You can manage to end up being an investor with this low cost of loaning. If you choose to buy and hold a few properties over the long-term, you'll never need to worry about retirement. Gradually, your occupants will pay down your low-interest property financial obligation, so your only costs will be taxes, insurance coverage, and maintenance. And the rest of the ongoing rent checks go directly towards moneying your retirement in eternity.

How What Is Pmi In Real Estate can Save You Time, Stress, and Money.

Let's go into eight various methods you can end up being an investor. "Buy and Hold" is the timeless method to invest in real estate. You purchase a property, and you hold it for the foreseeable future, renting or leasing it out to produce income. This buy-and-hold design accounts for 6 out of our 8 ways to buy realty. However each of these 6 gets an unique spin, as you'll see ... Buying a single-family rental residential or commercial property (home or condominium) is a terrific starting point for anyone who wants to be a genuine estate investor. You simply buy a home and discover a great occupant.

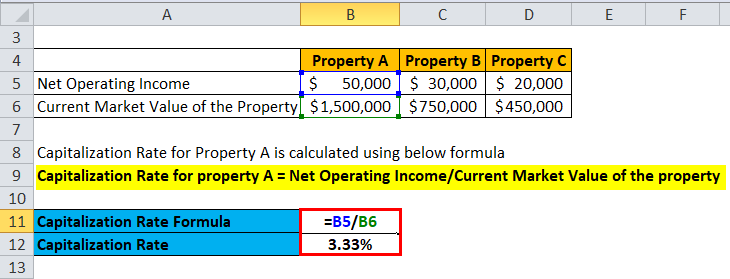

Income is fairly passive once your occupants get moved in. You can possibly renew one lease for many years if you have great tenants - What is cap rate real estate. The only real work needed is to handle a couple of regular maintenance calls annually. If you only own one residential or commercial property, and your tenants vacate, you don't have any earnings to cover the regular monthly costs of ownership until you get new occupants relocated. There is always some risk that your occupants may miss payments, avoid out on the lease, or harm the home. The security deposit uses some protection, and (worst case scenario) you constantly have the choice to take legal action against the renter for monetary and home damages if required.

Talk with a loan provider about your funding options so you'll know just how much cash you'll need to invest out-of-pocket. 1. When you have the cash, go back to your loan provider to get pre-approved for a loan. This will reveal sellers that you're a major purchaser and will provide your offer more weight. 1. Start searching for homes that can make enough in rent to more-than-cover your home loan, insurance, taxes, and upkeep. 1. Purchase your financial investment home and find yourself some good occupants. If your financial investment home is in a prime travel spot, you may wish to consider making it a shorter-term trip rental.

Believe Airbnb. You furnish the property, down to the utensils, linens, and even toiletries. You lease out the space for as low as one night at a time (but typically for weeks or perhaps a couple months). And you, or your residential or commercial property supervisor, offer your guests with an unique place to stay while they're taking a trip. You can charge a higher nightly rate on trip leasings than on long-lasting leasings. What does contingent in real estate mean. You'll be able to use the home yourself as a villa when it's not rented. You either require to be actively associated with handling appointments and check-ins/check-outs or work with a property manager to manage it.

Not known Facts About Who Pays Real Estate Commission

1. Start the exact same way you would with a single family house. 1. When you've acquired the home, furnish and decorate it to match your target audience's expectations. 1. List the rental on sites like Airbnb, who can deal with appointments, payments, and evaluates for you for a little commission. Multi-family property might be a 2-unit duplex, a 400-unit luxury home complex, or anything in between. It's not much various from owning a single-family rental residential or commercial property. You simply have more systems to handle. You might live in one of the units yourself. This is a fantastic chance to have the rent from the other systems cover the cost of your unit.

You 'd wesley likewise be able to watch on the structure living onsite. Multiple renters mean immediate diversity. If one renter leaves, you still have the other units offsetting your expenses up until you can get a brand-new tenant moved in. The in advance investment is normally higher because the expense of a multi-family property is normally higher than a single-family home. More occupants indicate more time invested managing them. Or you might hire a residential or commercial property manager to manage them for you. The process to get going is the exact same just like a single family home, but instead of discovering one great occupant, you'll find a great tenant for each unit.